How is e-invoicing compliance changing the game?

This blog is based on our recent e-invoicing compliance webinar by Kamil Cichocki and Sami Nikula on 6th of September 2024.

The key to seamless tax and business efficiency

In today’s rapidly evolving digital economy, e-invoicing is no longer just an efficiency tool—it’s a critical component for businesses to remain compliant with tax regulations. Governments worldwide are tightening regulations, pushing companies to adopt e-invoicing for smoother operations, better tax compliance, and standardized processes. Let’s discover more about compliant e-invoicing, why it matters, and how businesses can stay ahead of the curve.

What is e-invoice compliance?

At its core, e-invoice compliance refers to adhering to legal and technical requirements for creating and managing electronic invoices. These rules, typically set by governments or tax authorities, ensure that e-invoices:

- Meet national or regional tax laws.

- Follow approved data formats and exchange protocols.

- Maintain accurate reporting and data storage.

The goal of e-invoice compliance is not only to standardize invoicing processes but also to enhance tax accuracy and streamline transactions between businesses and governments.

Why is compliance important?

Governments are increasingly focused on Continuous Transaction Controls (CTC) to monitor and close gaps in tax collection, particularly with VAT. However, the benefits of compliance extend beyond regulatory obligations:

Efficiency gains: By adopting a standardized e-invoice format, businesses can automate transactions, reduce errors, and save both time and resources.

Cost savings: Standardization encourages companies to simplify their invoicing processes, cutting down on manual work and boosting automation.

Business continuity: Failing to comply with regulations can lead to penalties, making it crucial for businesses to stay ahead of evolving mandates.

The evolving e-invoicing landscape

The global e-invoicing market is booming. By 2024, over 560 billion invoices will be exchanged worldwide, with an expected 16% of these being e-invoices, growing at a CAGR of 20% until 2028. The market’s value, currently at $8.9 billion, is forecasted to reach $23.7 billion by 2028 (source: Watch the tornado by billentis).

Yet, the landscape remains fragmented. While some regions focus on unified standards like Peppol and ViDA (VAT in the Digital Age), country-specific regulations still dominate, making it crucial for businesses to stay informed about local laws.

Understanding regional compliance: What to know

E-invoicing regulations can vary significantly across countries. Understanding the specific mandates in different regions is essential for global businesses to ensure compliance. The complexity of e-invoice compliance lies in the different models adopted by various countries. Below you can find some selected examples from Northern Europe.

Germany has introduced a B2B mandate for domestic e-invoicing. The country will remain in a post-audit model and tax reporting requirements for now remain as is, but this mandate will impact all companies operating in Germany. The timeline for e-invoicing compliance in Germany is as follows:

- January 1, 2025: All businesses must be able to receive e-invoices.

- January 1, 2027: Companies with revenues exceeding €800,000 must start issuing structured e-invoices, following the EN 16931 standard. At this point, issuing paper invoices will no longer be allowed.

- January 1, 2028: Full mandatory e-invoicing for all companies, regardless of revenue.

Germany has embraced formats like XRechnung and ZUGFeRD 2, and channels such as Peppol for e-invoice exchange. Cross-border invoicing remains unaffected, but the move towards mandatory e-invoicing will streamline domestic transactions.

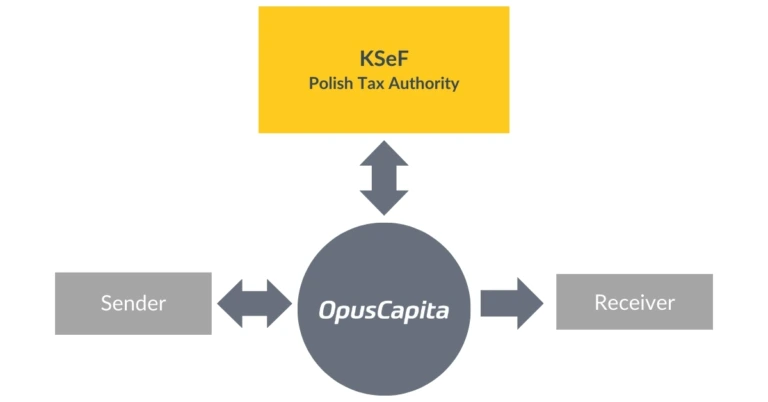

Poland is transitioning to a centralized e-invoice platform known as Krajowy System e-Faktur (KSeF). KSeF is set to become the sole platform for issuing and receiving invoices, marking a significant shift towards automation and efficiency in Poland’s tax reporting processes:

- February 1, 2026: Mandatory use of KSeF for entities with turnovers above PLN 200 million (~€46 million).

- April 1, 2026: All Polish VAT-registered entities must adopt KSeF for issuing and receiving e-invoices.

Invoices in Poland will no longer be valid unless exchanged through the KSeF platform, and only certified providers will be authorized to transfer and manage invoices on behalf of businesses. This platform also handles digital archiving for 10 years, offering a streamlined and compliant way to store invoices.

Belgium has taken significant steps towards adopting Peppol as the standard for e-invoice exchange. By January 2026, all entities with a Belgian VAT number will be required to issue and receive invoices through the Peppol network:

- January 1, 2026: Full compliance with Peppol standards will be mandatory, aligning with the EN 16931 rules.

Only certified Peppol Access Points will be authorized to exchange invoices. However, some exceptions apply, including entities under the special flat-rate regime, bankrupt businesses, and VAT-exempt taxpayers. Businesses will also need to maintain digital archives of their invoices for seven years, with data accessible from within Belgium, although storage can be located elsewhere.

Estonia is set to mandate that buyers listed in the Estonian e-Business Register can legally enforce e-invoicing on suppliers from January 2025:

- January 1, 2025: Buyers registered as e-invoice receivers can mandate suppliers to issue e-invoices, but the transmission method will not be regulated.

The use of Peppol and other point-to-point transmission methods will allow businesses flexibility, though they must follow the EN 16931 standard for structured invoice formats. Both private and public sector entities are included in this regulation, ensuring a comprehensive shift toward digital invoicing across the country.

Denmark is adopting strict regulations for digital bookkeeping and invoicing as part of its move towards complete digitization:

- January 1, 2024: Companies must submit annual reports through Digital Bookkeeping Systems (DBS).

- January 1, 2025: Companies using in-house-developed bookkeeping software must comply.

- January 1, 2026: Smaller companies not obliged to submit annual reports but with turnover above DKK 300,000 (~€40,000) must also comply.

The law requires businesses to use certified software for issuing invoices, and companies must register with the NemHandel network or Peppol for secure transmission. Invoices must also be digitally archived for 5 to 10 years, and receivers must have ERP systems integrated with the NemHandel and Peppol networks.

What are the best practices for e-invoice compliance?

To navigate this complex landscape, businesses must:

Stay informed on local regulations: Compliance laws can vary greatly between countries and are constantly evolving.

Adopt standard formats: Using international standards like Peppol ensures seamless interoperability across borders.

Invest in scalable solutions: As regulations change, ensure your e-invoicing system is flexible enough to adapt.

Integrate systems: Your e-invoicing platform should sync with ERP, accounting, and CRM systems to reduce manual input.

Plan for cross-border transactions: Especially in the EU, cross-border invoicing requires careful attention to ensure compliance in multiple jurisdictions.

How OpusCapita can help

At OpusCapita, we are at the forefront of e-invoicing compliance. Our solutions are designed to integrate with businesses across multiple countries, ensuring that companies not only comply with local regulations but also streamline their operations. Whether you’re preparing for upcoming changes like ViDA in Europe or looking to reduce your invoicing costs by 50-80%, we have the tools and expertise to help.

Please read more about different e-invoice models here.

Please book a meeting for further discussion about how we can help you in e-invoice compliance.

About the author

Sami has been working for over 20 years in the e-invoicing industry turning customer requirements into innovative solutions globally.

Name of the game: Excellence in e-invoicing compliance

Uncover the critical elements and game-changing strategies in the constantly shifting e-invoicing compliance landscape – and most importantly, learn how to master it. Get also updates on the latest changes in Germany, Poland, Belgium, Estonia, and Denmark.

Free webinar on September 4th, 2024, at 9 AM CET