Compliant e-invoicing

Ensure EN compliant e-invoicing, including the EU e-invoicing directive and EN 16931, as well as national rules, Peppol, GDPR, and more.

Legal compliance

Beyond EN compliant e-invoicing

Where legally compliant e-invoicing is relevant for all countries, there is always variation in the national rules. For suppliers, it means ensuring you’re compliant in the countries that you sell to, whereas buyers apply the compliance of your own country.

Process compliance

Meet partner & internal requirements

While we can provide custom B2B integration, we encourage rather using electronic message standards and formats, and the open network interoperability. With a combination of these, our experts are bound to find you a setup to suit your specific needs.

E-invoicing regulations fulfilled

We’ll ensure you’re compliant

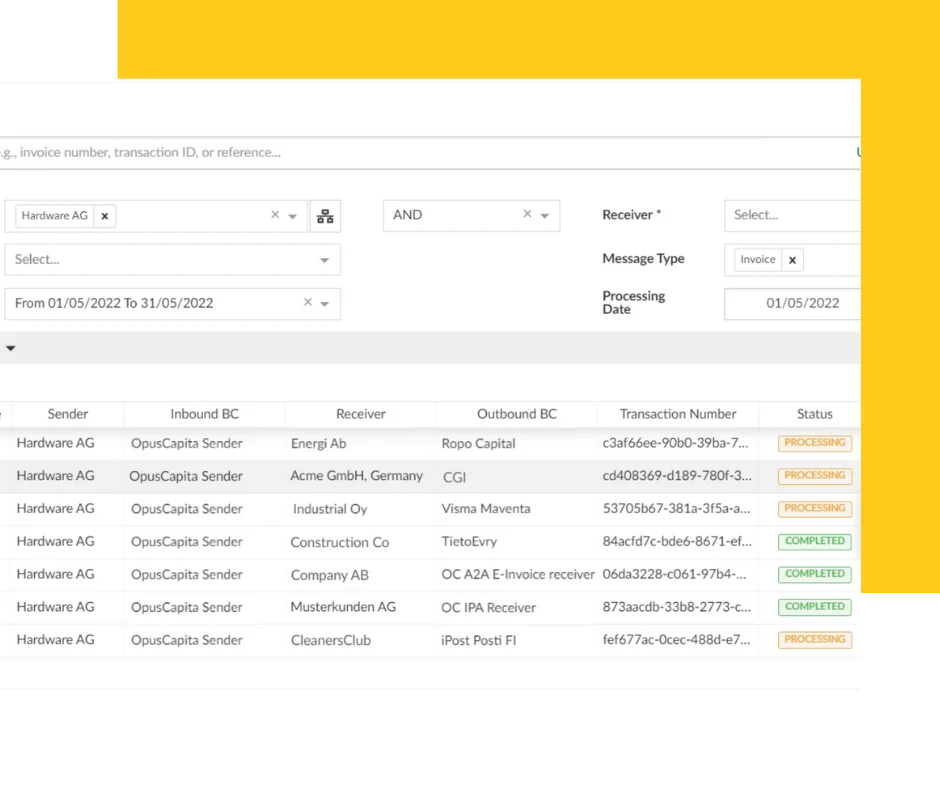

To exchange compliant e-invoices, you need both a network operator and a sending & receiving service that supports compliant formats, fits your process, and provides visibility.

Getting the operator and service provider in one, with decades of experience on top, ensures your peace of mind.

Benefit from EN compliant e-invoicing

Less paper, less PDFs, less manual work

Structured data allows for efficiency, data enrichment, 3-way matching and automation.

Clarity between the parties

When the invoice content is clear for the buyer, seller and the authorities, there are also less errors to fix afterwards.

Structured archiving of all transactions

Compliance creates a structured manner for continuous archiving of all that’s been sent and received.

EN compliant e-invoicing

EU e-invoicing directive

The European Directive on electronic invoicing (EN 2014/55 / EU) mandates all organizations within the EU Member States from the public to private sector, and companies of nearly all sizes, to consider the EU e-invoicing legislation when sending and receiving invoices.

Boost to e-invoicing

EU e-invoicing directive doesn’t only mandate to support EN compliant e-invoicing. It also promotes the uptake of e-invoicing, boosting the shift to reduce complexity and legal uncertainty in using e-invoices across the EU.

EU invoicing rules

Adding to the directive, the European standard on e-invoicing, EN16931 from 2017, defines the semantic data model for the core elements of an electronic invoice. The regulation is targeted to public and private companies as invoice senders and receivers, but it has and continues to affect also the economy in general.

EN compliant e-invoicing

To be legitimate, invoices in the EU must now contain the mandatory data defined in the e-invoicing standard. However, each Member State has had the possibility to implement the regulation to meet the national legislation.

Invoice content compliance

We encourage keeping up to the newest formats. They’re aligned with the same semantic data model as used by others, both nationally and internationally.

Seamless data flows

Structured data in the standard format allows you to send and receive invoices broadly with more clarity and less errors, and your ability for invoice automation improves. All of this leads to cost savings, ensuring great return on your investment – but most of all, provides you peace of mind.

How is Peppol related to EN16931?

Peppol as such is not part of the EN16931 standard. However, it is one possible interoperable infrastructure for complying with the regulation. The Peppol BIS 3 format is EN compliant with the UBL invoices.

National variance

Peppol provides a structured way to maintain different country rules in one infrastructure. There are national differences in how Peppol is used for EN compliant e-invoicing. Denmark, Austria, Croatia, and Finland use Peppol in parallel with their national schemas. On the contrary, Sweden, Norway, Poland, the Netherlands, Cyprus, and Germany use it as the main infrastructure.

EU e-invoicing directive

The European Directive on electronic invoicing (EN 2014/55 / EU) mandates all organizations within the EU Member States from the public to private sector, and companies of nearly all sizes, to consider the EU e-invoicing legislation when sending and receiving invoices.

Boost to e-invoicing

EU e-invoicing directive doesn’t only mandate to support EN compliant e-invoicing. It also promotes the uptake of e-invoicing, boosting the shift to reduce complexity and legal uncertainty in using e-invoices across the EU.

EU invoicing rules

Adding to the directive, the European standard on e-invoicing, EN16931 from 2017, defines the semantic data model for the core elements of an electronic invoice. The regulation is targeted to public and private companies as invoice senders and receivers, but it has and continues to affect also the economy in general.

EN compliant e-invoicing

To be legitimate, invoices in the EU must now contain the mandatory data defined in the e-invoicing standard. However, each Member State has had the possibility to implement the regulation to meet the national legislation.

Invoice content compliance

We encourage keeping up to the newest formats. They’re aligned with the same semantic data model as used by others, both nationally and internationally.

Seamless data flows

Structured data in the standard format allows you to send and receive invoices broadly with more clarity and less errors, and your ability for invoice automation improves. All of this leads to cost savings, ensuring great return on your investment – but most of all, provides you peace of mind.

How is Peppol related to EN16931?

Peppol as such is not part of the EN16931 standard. However, it is one possible interoperable infrastructure for complying with the regulation. The Peppol BIS 3 format is EN compliant with the UBL invoices.

National variance

Peppol provides a structured way to maintain different country rules in one infrastructure. There are national differences in how Peppol is used for EN compliant e-invoicing. Denmark, Austria, Croatia, and Finland use Peppol in parallel with their national schemas. On the contrary, Sweden, Norway, Poland, the Netherlands, Cyprus, and Germany use it as the main infrastructure.

Sounds complicated?

Worry not. A compliant e-invoice sending & receiving service will handle of all of it for you.

E-invoicing regulations

How EN compliant e-invoicing is fulfilled varies from country to country. However, commonly mandatory, structured data elements in all formats enable the seamless transformation of compliant invoices between formats. For example, invoice number and date are needed by the standard for VAT reporting.

E-invoicing in Finland

Companies in Finland are entitled to receive invoices in a compliant electronic format at request, and e-invoicing is mandatory with the authorities. The national formats are TEappsXML 3.0 and Finvoice 3.0.

E-invoicing in Sweden

The national e-invoice format, Svefaktura, is expected to expire soon. It’s replaced by Peppol Billing BIS 3, both among public authorities and private companies.

E-invoicing in Norway

The national e-invoice format, EHF 3.0, already matches Peppol Billing BIS 3, and the trend is strongly towards vast Peppol adoption.

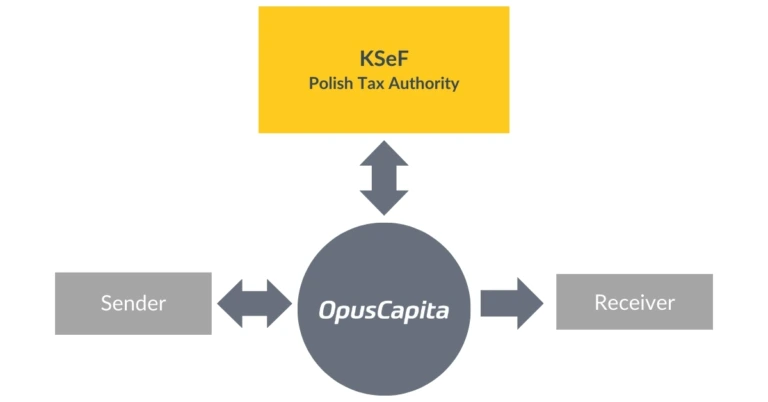

E-invoicing in Poland

E-invoicing in Poland will become mandatory as the country implements a Continuous Transaction Controls (CTC) model. Businesses will need to issue all B2B invoices in a structured format exclusively on the government platform, establishing this as the sole acceptable method for issuing and delivering invoices.

E-invoicing in Germany

Germany has introduced a B2B e-invoicing mandate to be fully effective from the 1st of January 2028 onwards, following the EN 16931 standard from the European Committee for Standardisation (CEN) and ViDA initiative. This means that Germany will gradually transform towards a more regulated e-invoicing model in the future.

Peppol

Peppol (Pan-European Public Procurement Online) is an interoperability infrastructure, co-funded by the European Commission and 18 government agencies. The goal is to simplify and standardize the B2G and B2B exchange of e-invoices, e-orders, and other supply chain documents.

There is national variance in e-invoicing regulations in terms of content (what invoice elements are mandatory), integrity and authenticity (e.g. digital signature, EDI and business control), and especially in archive compliance (for how long to archive, how to ensure authenticity, who has access, etc.). These national requirements must be met by your service provider in the country that you sell to or buy in.

OpusCapita Business Network comes with specifically developed technology and our team with decades of experience to ensure compliance both nationally and internationally, especially within Northern Europe.