How to improve your invoice data quality

Improved invoice data quality and other developments in invoice processing have made the practice much easier and faster than before, but have also made it more challenging for the accounts payable to improve at the same pace. This is because of the many inter-dependencies in the purchase-to-pay process.

It’s a common question whether for paper or traditional PDF invoices, it is beneficial to do line-level interpretation, that is, to interpret invoice rows on paper invoices – or whether interpretation on the invoice header level is good enough (invoice header level meaning e.g. invoice number, total amount, currency, due date, etc.). The answer is that it depends on what you want to achieve.

Header-level invoice data quality

Let’s take an example. Say you want to manage your invoices with as little manual input as possible, meaning that a certain predefined deviation between the order and the invoice is acceptable. Perhaps you expect a surcharge on freight, for example.

In this case, it would be sufficient to match the invoice only on the header level and to automate the inspection and approval process (provided the deviating net amount is within predefined tolerance limits). Thus, there would be no need for line-level interpretation.

Line-level invoice data quality

However, if you would want to check for all the inconsistencies between the rows in the order, the goods you have received, and what has been specified on the invoice, then you would need line-level interpretation, that is, to interpret the invoice rows. In this situation, the quality of the invoice data becomes essential in order to avoid unnecessary manual work or to investigate deviations that might turn out to be incorrect interpretations by the OCR recognition of the invoice data, and not actual errors in the invoice.

We always recommend that customers who want to use line-level invoice data should consider increasing their use of e-invoicing, instead of trying to interpret invoice rows from paper invoices. This way, the e-invoice will provide you with a higher invoice data quality overall, as the data is usable as such, and there’s no need for OCR recognition or other interpretation and manual verification from a non-electronic invoice.

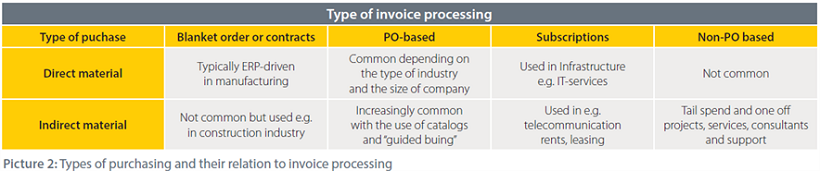

Invoice data quality with direct and indirect purchasing

Taking all the different types of invoice processing into account, the answer is even more complex. This is because specific types of invoices correlate to different types of purchases, some of which are easier to automate the invoices for than others. But the common denominator across the invoice handling process is invoice data quality.

Higher data quality with more e-invoices

In conclusion, there is no conflict when it comes to header or line-level interpretation. They complement each other and improve efficiency in the invoice process.

What is actually more important is your e-invoice ratio, meaning what portion of your purchase invoices come in readily in an electronic format – especially if you are prone to using line-level data. This is a closely watched KPI in top-performing organizations, with the best always having it in the green.